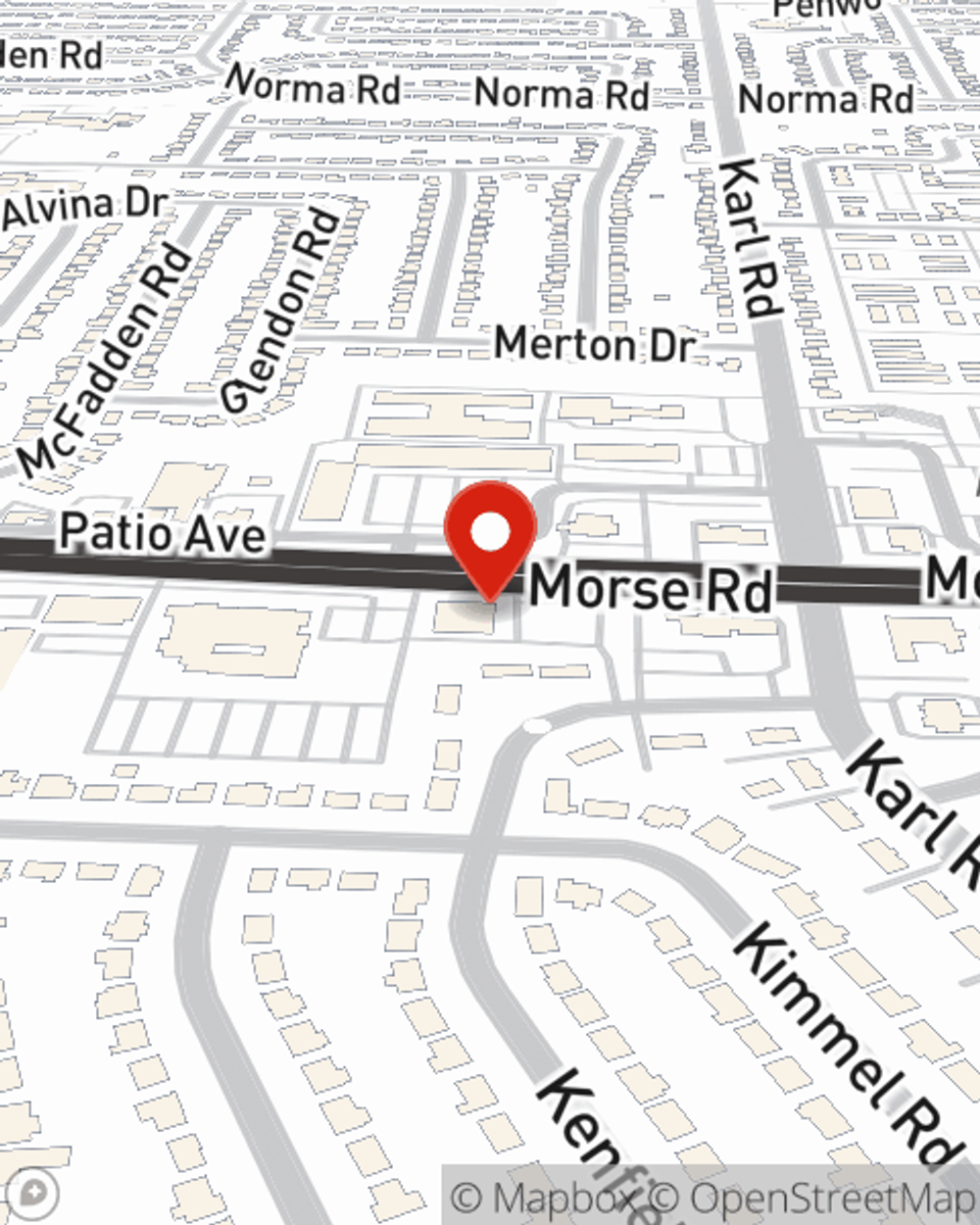

Business Insurance in and around Columbus

Calling all small business owners of Columbus!

No funny business here

- Columbus

- Newark

- Gahanna

- Franklin County

- Licking County

- Fairfield County

- Westerville

- Worthington

- Johnstown

- Easton

- Polaris

- Hilliard

- Grove City

- Lancaster

- German Village

- Clintonville

- Dublin

- Delaware

- Italian Village

- Short North

Business Insurance At A Great Value!

Though it's not fun to think about, it is good to recognize that some things are simply out of your control. Catastrophes happen, like an employee gets hurt on your property.

Calling all small business owners of Columbus!

No funny business here

Get Down To Business With State Farm

The unexpected is, well, unexpected, but it's better to expect it so that you're prepared. State Farm has a wide range of coverages, like business continuity plans or a surety or fidelity bond, that can be formed to develop a customized policy to fit your small business's needs. And when the unexpected does arise, agent Gianna Cone can also help you file your claim.

Don’t let worries about your business stress you out! Reach out to State Farm agent Gianna Cone today, and learn more about how you can meet your needs with State Farm small business insurance.

Simple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Gianna Cone

State Farm® Insurance AgentSimple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.